will the salt tax be repealed

It would reduce their 2021 taxes by an average of only 20. Dec 11 2021 Taxes.

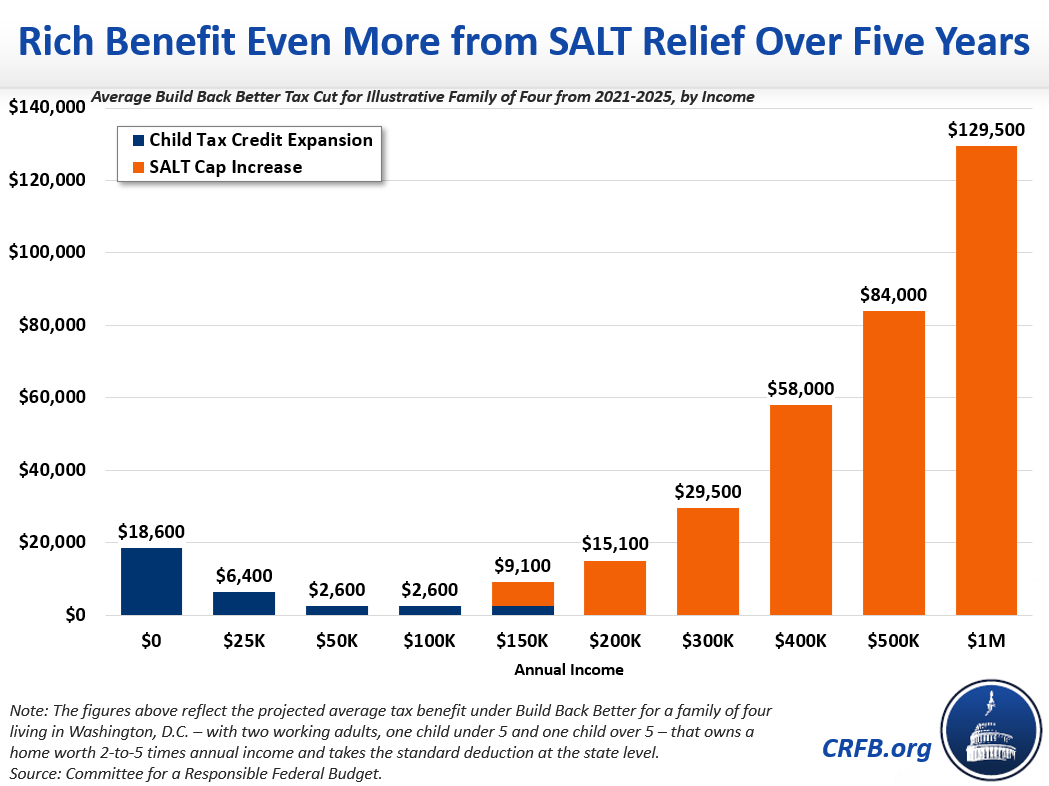

Build Back Better Salt Gains For The Rich Eclipse Child Credit Boost Committee For A Responsible Federal Budget

Such a plan would be still be very costly and regressive.

. Everything Keeps Coming Up Roses for the 200000 to 500000 Set. Even those making between 17500 and 250000 would get a tax cut of just over 400 or about 02 percent of after-tax income. Repealing the SALT cap in 2021 would reduce federal income tax liability by approximately 91 billion or 72 percent.

Joe Manchin D-WVa raised broader objections to President Bidens social spending and climate package. A group of Blue State Democrats has insisted on some SALT fix as their price for. Democrats are considering including in their social spending package a five-year repeal of the cap on the state and local tax SALT deduction sources told.

The HENRYs high earners not rich yet were treated well by. It contained a new provision that limited the deduction for state and local taxes commonly referred to as the SALT deduction to 10000 for a. SALT Repeal Just Below 1 Million is Still Costly and Regressive.

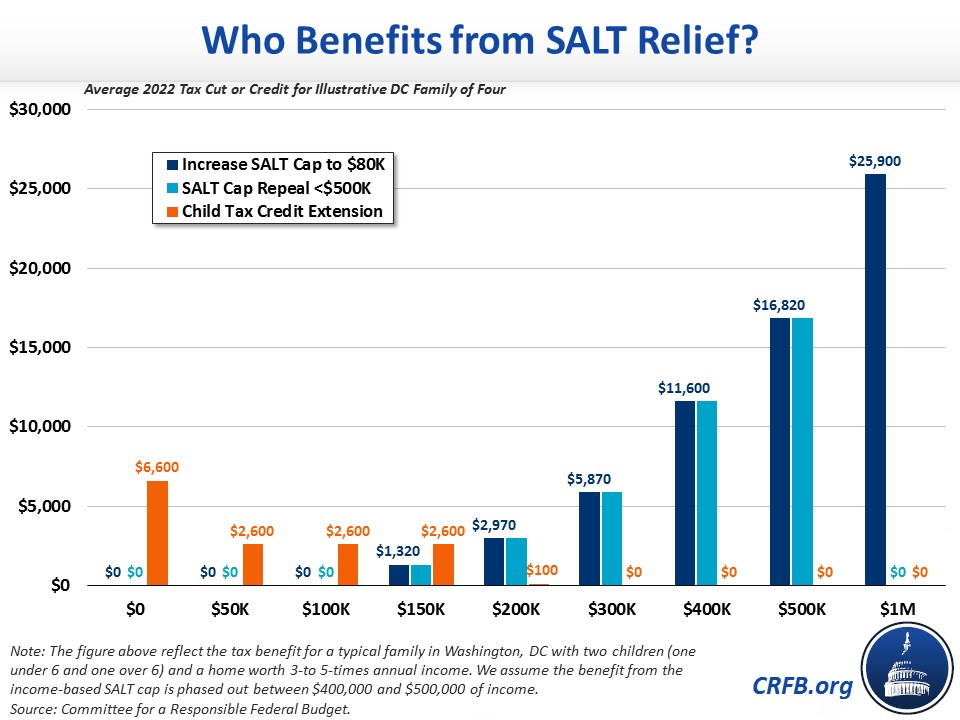

By contrast the higher SALT cap would boost after-tax incomes by 12 percent for those making between about 370000 and 870000. A possible compromise solution to reduce the havoc caused by the 2017 tax act would be to repeal the SALT tax for those earning less than 400000 per year. To avoid cutting taxes for households making over 1 million some politicians have suggested eliminating the State and Local Tax SALT deduction cap for households making below 900000 or 950000 per year.

A rollback of the cap on the state and local tax SALT deduction is on ice after Sen. It is important to understand who benefits from the SALT deduction as it currently exists and who would benefit from the deduction if the cap were repealed. And even with SALT reducing the hit state taxes will still raise top New Yorkers effective rate to 662 percent.

Marie Sapirie examines the proposal to repeal or at least raise the state and local tax deduction and the efforts to expand the child tax credit in terms of contrast and she questions whether. And some lawmakers have been fighting to include a. Enacted by the Tax Cuts and Jobs Act in 2017 the SALT cap has been a pain point for filers in high-tax states such as New York and New Jersey.

That should spell the end for the SALT deduction a benefit for. It would then be reinstated for five years after that which the aide. On Tuesday Mr.

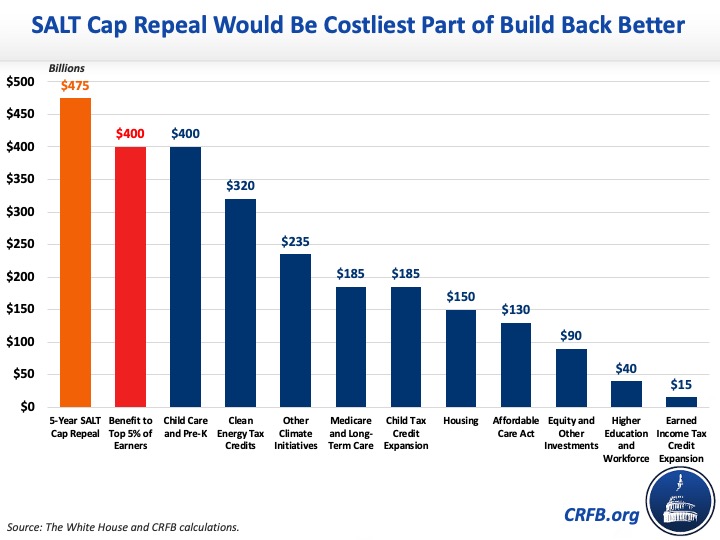

Democrats reportedly are considering a plan to repeal the 2017 cap on the state and local tax SALT deduction for 2022 and 2023 only. The Tax Policy Center found that only 3 of middle-income households would pay less in taxes if the SALT cap is. According to a committee aide a proposal on the table would repeal the 10000 cap for the 2021 through 2025 tax years.

Its a blow for Schumer who is up for reelection this year and pledged in 2020 to make repeal of the cap on SALT deductions a top priority if Democrats won control of the Senate. Its 632 percent for New Jersey and 647 percent for. The change may be significant for filers who itemize deductions in high-tax states and currently can.

Nov 19 2021 Taxes. That could appease the progressive Democrats without alienating most Republicans. As Congress struggles to pass the Build Back Better bill some congressional Democrats are exploring new proposals to raise the 10000 cap on the state and local tax SALT deduction.

House Democrats spending package raises the SALT deduction limit to 80000 through 2030. SALT Caps Temporary Repeal Is an Option Menendez Says Moving now would get relief right to taxpayers he says Lawmaker comment follows. Analyses found that repealing the cap would disproportionately benefit the wealthy.

The SALT deduction is one of the final tax details to be worked out in the House version of an up-to-35-trillion tax and social. A key Democratic lawmaker said a detailed final agreement to restore the federal deduction for state and local taxes could be reached this week with another advocate flagging a temporary repeal of the breaks limit as the likely proposal. A two-year SALT cap repeal.

As policymakers weigh whether to lift or repeal the 10000 cap on state and local tax SALT deductions enacted by the Tax Cuts and Jobs Act TCJA they have to wrestle with how that change would primarily benefit high-earning taxpayers. According to press reports the Senate is considering repealing the 10000 cap on the state and local tax SALT deduction for those making 500000 per year or less. 54 rows Some lawmakers have expressed interest in repealing the SALT cap which was originally imposed as part of the Tax Cuts and Jobs Act TCJA in late 2017.

This would be in place of the House plan to lift the cap to 80000 through 2030 and reinstate it at 10000 for 2031. Manchin told CNN that the Build Back Better bill is dead. Its a blow for Schumer who is up for reelection this year and pledged in 2020 to make repeal of the cap on SALT deductions a top priority if Democrats won control of.

October 4 2021.

A 25 000 Salt Deduction Cap Would Be A Modest Improvement Over The House S 80 000 Version

The Salt Deduction The Second Biggest Item In Democrats Budget That Gives Billions To Rich The Washington Post

Salt Cap Repeal Does Not Belong In Build Back Better Committee For A Responsible Federal Budget

3 Money Saving Tax Tips For Homeowners Utah Listing Pro Save Money Tax Tips Homeowner Tips Tax Season Real Estate Ta Tax Money Tax Season Saving Money

Salt Cap Repeal Below 500k Still Costly And Regressive Committee For A Responsible Federal Budget

5 Year Salt Cap Repeal Would Be Costliest Part Of Build Back Better Committee For A Responsible Federal Budget

How An 80 000 Salt Cap Stacks Up Against A Full Deduction For Those Making 400 000 Or Less